AQR Corporate Arbitrage: A Multifaceted Approach to Arbitrage Investing

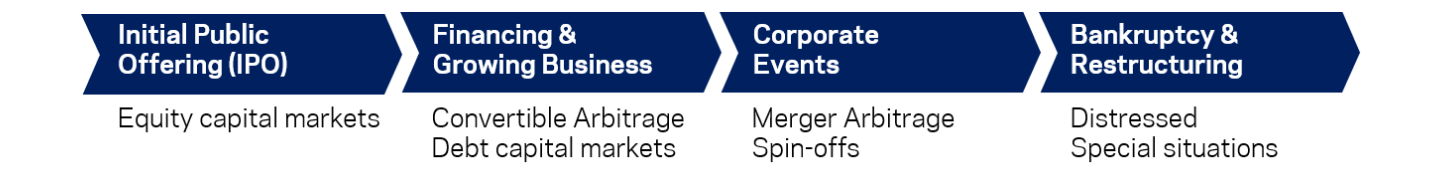

Corporate Arbitrage strategies seek to profit from corporate events, such as equity and debt issuances, mergers & acquisitions and bankruptcies. Because these strategies are tied to finance raising or control events of specific companies, they can provide a source of returns that is independent and diversifying from traditional equity and bond investments.

AQR’s Sustainable Corporate Arbitrage Strategy (‘the Strategy’) integrates three types of arbitrage strategies: Merger Arbitrage, Convertible Arbitrage, and Event-driven Investments. Each strategy is a diversifying addition to a traditional portfolio, and dynamic exposure to a combination of these strategies provides the opportunity to benefit from different types of corporate events. The Strategy employs our sustainable investment process, which features a positive tilt toward deals with more attractive ESG characteristics along with norms-based and dynamic screening.

Arbitrage opportunities can be created by financial events across the corporate lifecycle

A Unique Offering in the Arbitrage Space

20+ Years of Experience

Seeks Attractive Risk-Adjusted Returns

Dynamic Approach

Portfolio Diversification

Incorporates Sustainability

Attractive Current Environment

Related Funds

There can be no assurance that any investment strategy will be successful.

The information contained on this website is for informational purposes only and does not constitute an offer or invitation to buy, sell or otherwise transact in any security. The information on this site is directed only at persons or entities in any jurisdiction or country where such access to information contained on this website and use of such information is not contrary to local law or regulation. Accordingly, all persons who access this website are required to inform themselves of and to comply with any such restrictions. The prospectus, KIID and the latest periodic reports for each fund are available free of charge.

Past performance does not predict future returns.

This is a marketing communication in the European Economic Area (“EEA”) and approved as a Financial Promotion in the United Kingdom (“UK”). It is only intended for Professional Clients.

Information for clients in the EEA

AQR in the European Economic Area is AQR Capital Management (Germany) GmbH, a German limited liability company (Gesellschaft mit beschränkter Haftung; “GmbH”), with registered offices at Maximilianstrasse 13, 80539 Munich, authorized and regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht, „BaFin“), with offices at Marie-Curie-Str. 24-28, 60439, Frankfurt am Main und Graurheindorfer Str. 108, 53117 Bonn, to provide the services of investment advice (Anlageberatung) and investment broking (Anlagevermittlung) pursuant to the German Securities Institutions Act (Wertpapierinstitutsgesetz; “WpIG”). The Complaint Handling Procedure for clients and prospective clients of AQR in the European Economic Area can be found here: https://ucits.aqr.com/Legal-and-Regulatory.

Information for clients in the United Kingdom

The information set forth herein has been prepared and issued by AQR Capital Management (Europe) LLP, a UK limited liability partnership with its office at Charles House 5-11, Regent St., London, SW1Y 4LR, which is authorised and regulated by the UK Financial Conduct Authority (“FCA”).