Understanding Style Investing

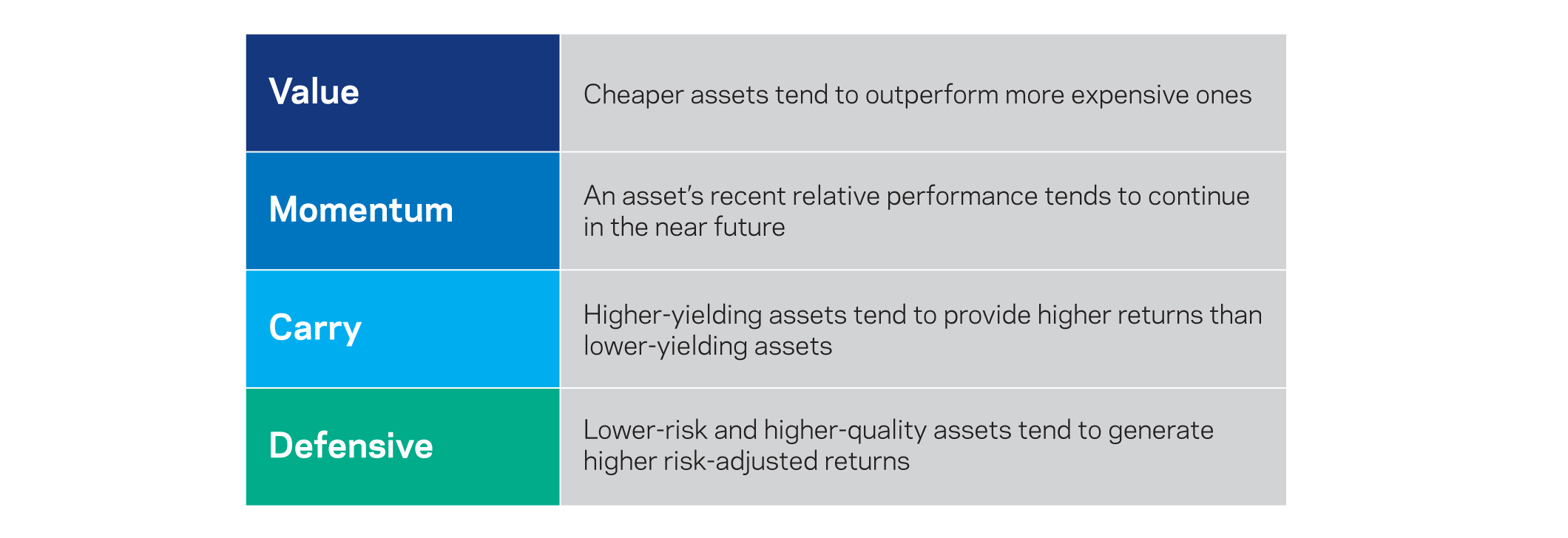

Style investing uses a disciplined, systematic process to identify securities for a portfolio based on consistent and repeatable drivers of return. These are called styles, factors or themes, and are grounded in empirical evidence and economic intuition. Some of the most well-known styles are Value, Momentum, Carry, and Defensive. These, among many others, form the building blocks of AQR’s systematic approach to investing.

How does it work?

Each of these four styles identifies a specific set of characteristics in the securities of an asset class that help distinguish winners from losers.

Resources

Related Funds

Systematic Equity Investing

Our research shows that combining multiple pervasive styles in one portfolio, implemented across a broad investment universe including multiple asset classes and countries, can provide distinct portfolio benefits over time.

There can be no assurance that any investment strategy will be successful.

This product is based overseas and is not subject to UK sustainable investment labelling and disclosure requirements.

Diversification does not eliminate the risk of experiencing investment losses.

There can be no assurance that any investment strategy will be successful.

The information contained on this website is for informational purposes only and does not constitute an offer or invitation to buy, sell or otherwise transact in any security. The information on this site is directed only at persons or entities in any jurisdiction or country where such access to information contained on this website and use of such information is not contrary to local law or regulation. Accordingly, all persons who access this website are required to inform themselves of and to comply with any such restrictions. The prospectus, KIID and the latest periodic reports for each fund are available free of charge.

Past performance does not predict future returns.

This is a marketing communication in the European Economic Area (“EEA”) and approved as a Financial Promotion in the United Kingdom (“UK”). It is only intended for Professional Clients.

Information for clients in the EEA

AQR in the European Economic Area is AQR Capital Management (Germany) GmbH, a German limited liability company (Gesellschaft mit beschränkter Haftung; “GmbH”), with registered offices at Maximilianstrasse 13, 80539 Munich, authorized and regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht, „BaFin“), with offices at Marie-Curie-Str. 24-28, 60439, Frankfurt am Main und Graurheindorfer Str. 108, 53117 Bonn, to provide the services of investment advice (Anlageberatung) and investment broking (Anlagevermittlung) pursuant to the German Securities Institutions Act (Wertpapierinstitutsgesetz; “WpIG”). The Complaint Handling Procedure for clients and prospective clients of AQR in the European Economic Area can be found here: https://ucits.aqr.com/Legal-and-Regulatory.

Information for clients in the United Kingdom

The information set forth herein has been prepared and issued by AQR Capital Management (Europe) LLP, a UK limited liability partnership with its office at 15 Bedford Street, London, WC2E 9HE, which is authorised and regulated by the UK Financial Conduct Authority (“FCA”).